Individual 401k contribution calculator

High contribution limits401ks have relatively high annual contribution limits. Earned income in the case of a self-employed individual up to the annual contribution limit.

Solo 401k Contribution Calculator Solo 401k

Lets say you made your max 401k contribution at 19000 and your employer matches you dollar for dollar.

. 401k Contribution as discussed is a type of calculator wherein an individual can calculate the amount he can invest in a 401k plan and what amount his employer will contribute. 401k Checklist PDF Helps you keep your 401k plan in compliance with important tax rules. Penalties The payment demanded for not adhering to set rules.

Check out a solo 401k which offers similar tax benefits to an employer-sponsored 401k plus you can sock away almost nine times more per year than in an individual retirement account IRA. Lump-sum Distribution The withdrawal of funds from a 401k. 19000 x 2 38000.

Login or enroll to your Defined Contribution Workplace Retirement account. Information and interactive calculators are made available to you as self-help tools for your. One Participant 401k Plans One-Participant 401k Plans More In Retirement Plans.

Learn how to start a self-employed 401k plan with Fidelity by following these step-by-step instructions or call us at 800-544-5373 for guidance throughout the entire process. If you have another job ie a day job your maximum employee contribution is reduced by any contributions you made as an employee to another 401k or 403b. IRA and Roth IRA.

If you increase your contribution to 10 you will contribute 10000. This has been a guide to the 401k contribution calculator. State Income Tax Rate The percentage of taxes an individual has to pay on their income according to the laws of their state.

Some rules of thumb for reading the SIMPLE IRA contribution calculator results include. Employers dont have a specific 401k contribution limit placed on them but the IRS limits 401k contributions from all sources including employer match to 56000. If you are 50 years old or older you can also contribute up to 6500 in catch-up contributions on top of your individual and employer contributions.

Monday - Friday 8 am. Just a little bit short of your retirement savings goal. An IRA individual retirement account is a personal tax-deferred account the IRS created to give investors an easy way to save for retirement.

Individual 401k plans do not need to be funded annually. These two tax-advantaged retirement plans are designed. You can only contribute a certain amount to your 401k each year.

Rollover Moving the 401k contribution to another retirement fund option often an IRA. 8 Sticking with our example above maxing out your Roth IRA and investing 6000 into your account brings your total retirement savings for the year to 9750. What you provide as the employee and the match from your employer if applicable.

High annual contribution limit. Rollover IRA401K Rollover Options Combining 401Ks How to Rollover a 401K. For the tax year 2022 which youll file a return for in 2023 that limit stands at 20500 which is up 1000 from the 2021 level.

Types of Retirement Plans. Use the interactive calculator to calculate your maximum annual retirement contribution based on your income. Simply enter your name age and income and click Calculate The result will be a comparison showing the annual retirement contribution that would be permitted based on your income in a SEP IRA Individual 401k Defined Benefit Plan or.

Creditor protection401k funds are generally protected from. You do not report the employee portion of the Solo 401k contribution on Schedule C. General guidance on participating in your employers plan.

And read the Defined Contribution Retirement Plan Basic Plan Document No. In 2021 you can put up to 6000 into a Roth IRA and an extra 1000 catch-up contribution if youre age 50 or older. Annual SIMPLE IRA Contributions.

The maximum combined contribution including salary deferral cannot exceed 58000 for tax year 2021 or 64500 if age 50 or over. The combined contribution limit for all of your traditional and Roth IRAs is 6000 in 2022 7000 if age 50 or older Key pros. The purpose of Schedule C is calculating your business expenses before determining your earned income from the business.

Ditto for catch-up contributions. Correct a 401k Plan. Operate and Maintain a 401k Plan.

There are two sides to your contribution. Your ex-spouse will generally have access to a marital share of your retirement accounts after a divorce but there are ways to protect your retirement plan and financial assets. Mid-year Amendments to Safe Harbor 401k Plans and Notices.

The total 401k contribution from you. How to Read Your SIMPLE IRA Calculator Results. 61000 for tax year 2022 or 67500 if age 50 or older.

Please visit our 401K Calculator for more information about 401ks. Fine-tune your education savings plan. The employer contribution is limited to half of the difference between your net earnings from self-employment and the employee contribution.

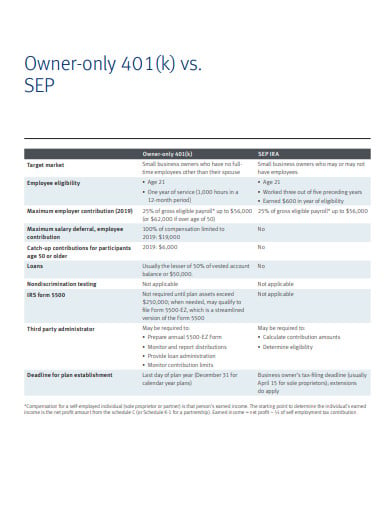

04 PDF Download print and complete the Self-Employed 401k Adoption Agreement PDF. This means your annual limit jumps to 7000 potentially adding more strength to the power of compounding and greater savings for you. Use the Individual 401k Contribution Comparison to estimate the potential contribution that can be made to an Individual 401k compared to Profit Sharing SIMPLE or SEP plan.

529 State Tax Calculator Learning Quest 529 Plan. For 2022 the limit is 20500 for those under 50 and 27000 for those over 50. In 2022 employers and employees together can contribute up to 61000 up from a limit of 58000 in 2021.

SIMPLE IRA contributions should be at least 3 percent of annual compensation or 5000If theyre more than 20000 or 8 percent to 10 percent of your employee income it may be better to use. You qualify for an extra 1000 IRA catch-up contribution. What are the contribution limits.

On the other hand the combined annual IRA limit is 6000 for those under 50 and 7000 for those above 50. This article will help answer frequently asked questions about what happens to a 401k or other similar retirement accounts in the event of a divorce. Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a 100000 salary.

Operating a 401k plan. 20500 in 2022 19500 in 2020 and 2021 or 27000 in 2022 26000 in 2020 and 2021 if age 50 or over. Self-Employed 401k Contributions Calculator.

Contribution Transmittal Form Use this form when making contributions to employee aka. Only distributions are taxed as ordinary income in retirement during which retirees most likely fall within a lower tax bracket. For pass-through businesses the employee and employer portion of the Solo 401k contribution is reported on line 15 of.

This is one plan wherein an individual can defer tax payments. Locate tools calculators and articles to help you meet financial goals. Employers offer 403b and 401k plans to help their employees save for retirement but chances are you wont have to choose between them.

The 2022 401k individual contribution limit is 20500 up from 19500 in 2021. In the US the traditional IRA Individual Retirement Account and Roth IRA are also popular forms of retirement savings. Employer match if offered.

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Limits And Types

How Much Can I Contribute To My Self Employed 401k Plan

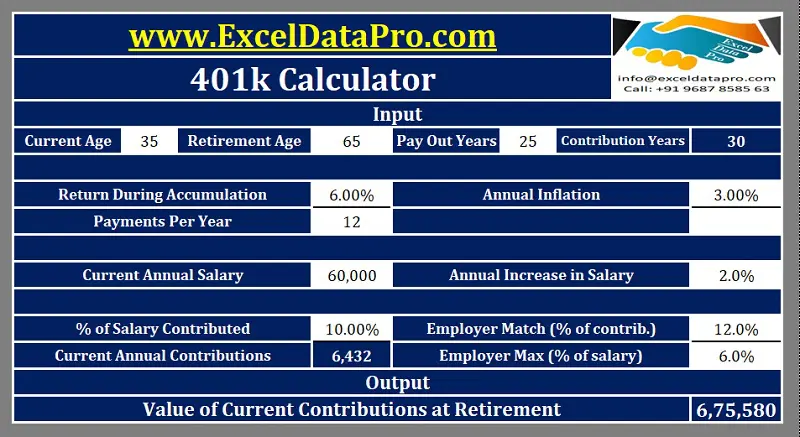

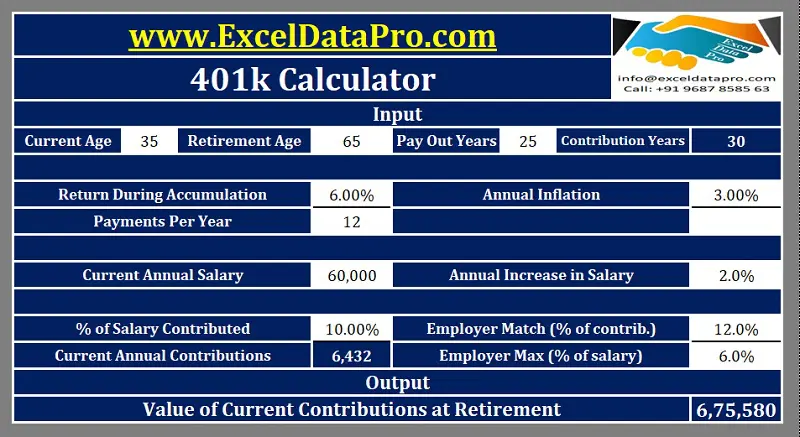

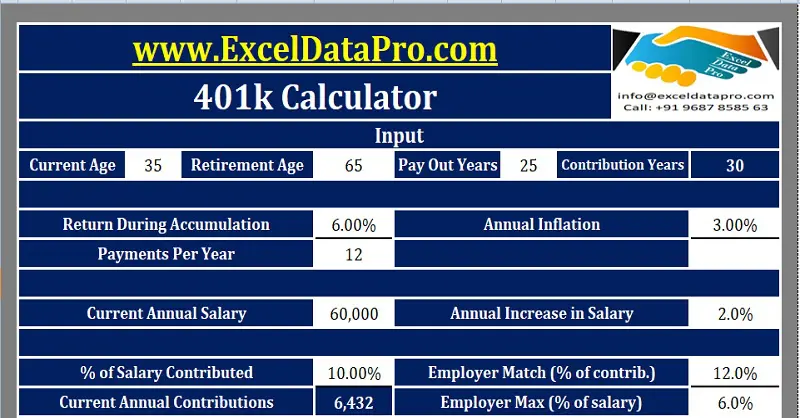

Download 401k Calculator Excel Template Exceldatapro

Solo 401k Contribution Limits And Types

Retirement Services 401 K Calculator

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Solo 401k Contribution Calculator Solo 401k

Solo 401k Contribution Limits And Types

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Limits And Types

Free 401k Calculator For Excel Calculate Your 401k Savings

2020 2021 Solo 401k Contributions How To Calculator S Corporation C Corp Llc As S C Corp W 2 Youtube

Making Year 2022 Annual Solo 401k Contributions Pretax Roth And Voluntary After Tax A K A Mega Backdoor My Solo 401k Financial

Download 401k Calculator Excel Template Exceldatapro

Here S How To Calculate Solo 401 K Contribution Limits

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial